Creating Optimal Portfolios

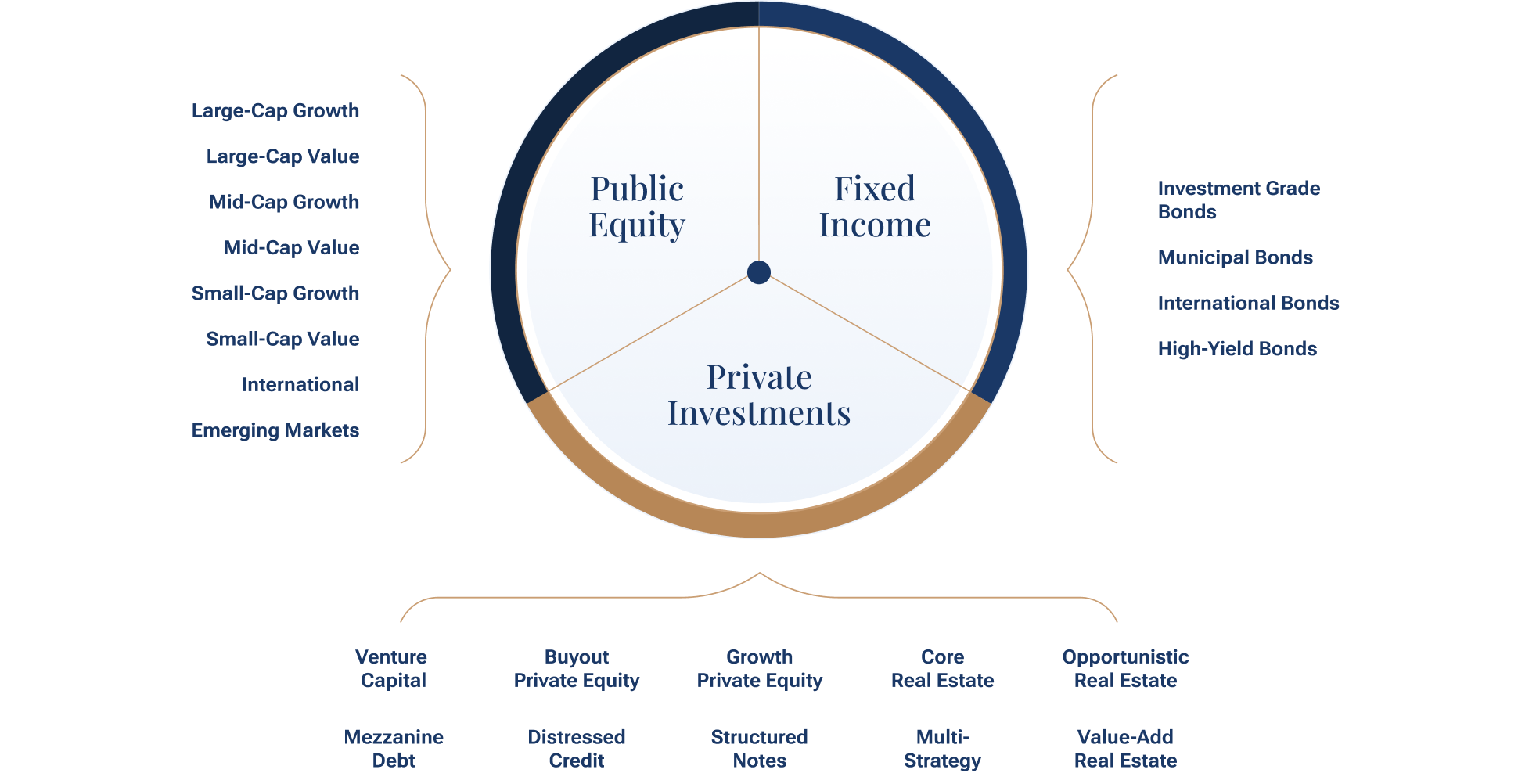

We create individualized investment portfolios that are risk-appropriate, returns optimized, and tax-efficient. Where appropriate, we incorporate institutional-quality private investments to capture illiquidity premiums or yield opportunities.

Furthermore, we believe cost is a critical factor in any successful investment strategy and therefore offer fully transparent pricing that is well-below industry standard.

Black Diamond Difference

We believe a successful investing strategy is linked to a holistic financial plan.

Tax-Efficiency

We structure portfolios to minimize taxes and maximize gains.

Customization

We strive to exceed each client's unique financial goals.

Control

We focus on things we can control like low fees, taxes, diversification, etc.

Long-Term Focus

We believe successful investors are patient and strategic.

Diversification

We proactively manage risk through broad diversification.

Financial Planning

We act as personal CFOs for our clients, helping with all aspects of their financial lives.

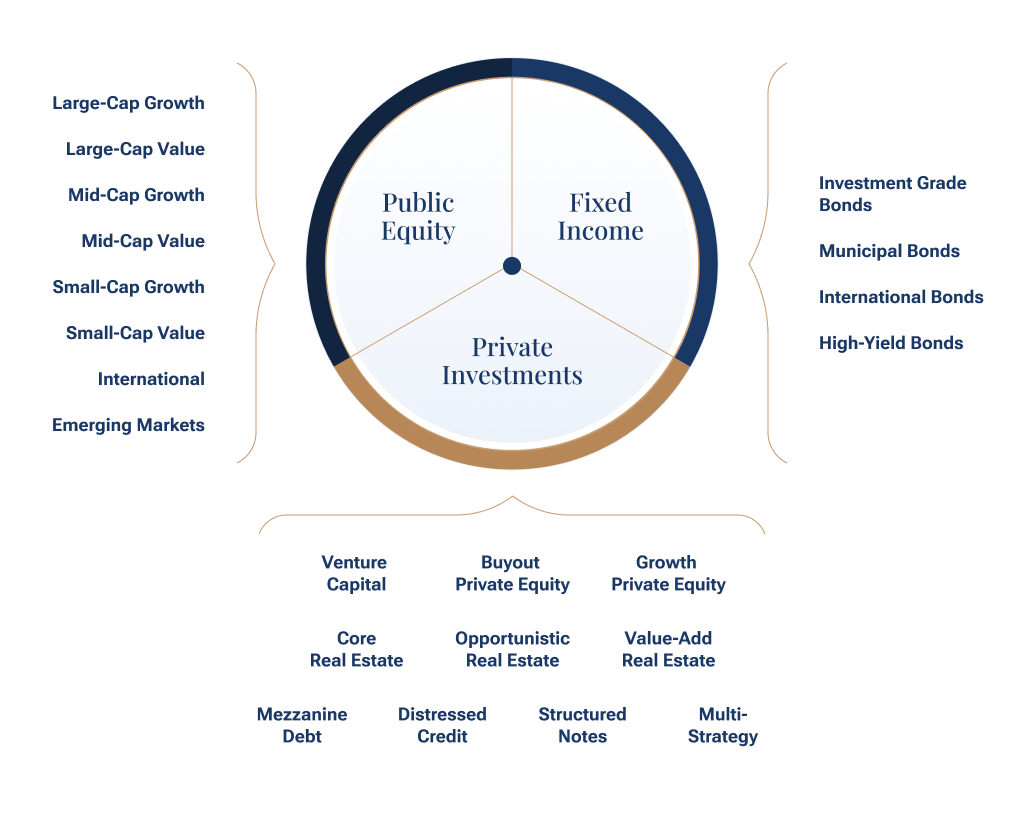

Portfolio Construction Drives Successful Investing

According to academic research, over 90% of portfolio returns are determined by the allocation percentage among various asset classes. Our investment team follows a rigid and documented process to select the optimal investments and asset allocation frameworks for our clients.

What to Expect

Conversation

We look forward to speaking with you to learn more about your financial life and goals.

This information enables us to customize our recommendations to your specific needs.

Review

Leveraging our proprietary resources, we complete a comprehensive analysis of your current investments.

Recommendation

We present a long-term investment plan that covers financial planning strategies and specific investments.

Implementation

Now that the ground work has been established, we will carefully transition your portfolio and begin implementing the recommended financial planning strategies.

Staying on Track

We have established a rigorous process of continuous portfolio monitoring to ensure your portfolio adapts to life’s natural changes and unexpected events.